Cairns Real Estate Market Update – October 2025: Strong Growth, Tight Supply, and a Shifting Landscape

The Cairns property market has continued to show remarkable resilience through 2025, with demand for both established homes and vacant land remaining strong. Despite affordability pressures and rising build costs across the nation, the Far North Queensland market stands out for its steady population growth, limited new supply, and rising land values.

Vacant Land: Tight Supply Driving Price Growth

Vacant land remains one of the hottest commodities in Cairns this year. The median land price hit around $340,000 in July 2025, up significantly from $265,000 in January 2024, a jump of nearly 30% in just 18 months. However, while prices climb, sales volumes are trending down, dropping from 67 sales in February 2024 to around 45 by February 2025.

This reflects a clear imbalance between supply and demand: there are fewer lots available, and those that do hit the market are selling fast. Developers are releasing land in smaller, staggered stages, and much of it is sold before titles are even issued.

The Southern Growth Corridor: Affordable but Tightening

The southern corridor, stretching from Gordonvale through Edmonton and Bentley Park, continues to be Cairns’ major growth hub. Affordability has long been its main appeal but the price gap between this corridor and inner Cairns suburbs is rapidly narrowing. Median land prices in Bentley Park and Edmonton now sit around $260,000, up from $220,000 at the start of 2024.

The challenge is supply. Many new developments in the area are selling out before completion, and there’s growing concern about infrastructure bottlenecks, particularly in the Mt Peter–Edmonton–Gordonvale precincts. While there’s plenty of land earmarked for housing, trunk infrastructure delays (such as water, sewer, and road services) are slowing progress. Without clear funding commitments, developers are hesitant, adding further pressure to supply.

Northern Beaches: Demand Outpacing New Releases

On the northern beaches, estates like The Palms at Kewarra Beach have been met with strong demand. But as these final stages sell out, there are no major new land releases planned in the near term. This tightening supply could place upward pressure on land prices and established homes along Cairns’ popular coastal strip.

Population Growth and Migration Fueling Demand

Cairns’ population continues to grow at a healthy rate, supported by interstate migration and lifestyle-driven relocations. The region’s affordability, tropical lifestyle, and improving infrastructure have kept it appealing to both owner-occupiers and investors. However, this steady demand combined with limited new land supply is pushing prices higher and straining affordability.

Rental Market: Severe Shortage, Rising Yields

The Herron Todd White data shows Cairns remains in a “severe shortage” of rental property relative to demand. Vacancy rates are low and steady, keeping rental prices firm. This ongoing tightness in the rental market is underpinning investor confidence, even as borrowing costs remain elevated compared to pre-2024 levels.

Where Cairns Sits in the Property Cycle

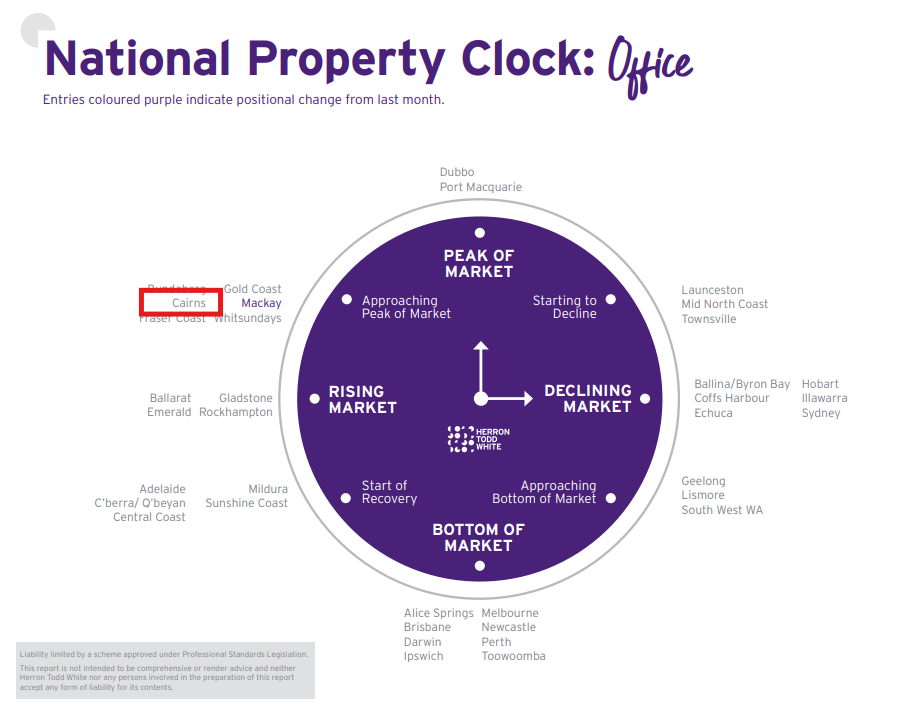

According to the national property clock, Cairns is firmly in a “rising market” phase for both houses and units. This positions it alongside other strong-performing Queensland regions such as Townsville and the Whitsundays. The consistent upward movement suggests continued momentum heading into 2026 particularly as national interest rates ease and infrastructure planning gradually catches up.

Herron Todd White Property Clock

Outlook for 2026

Looking forward, the Cairns market is expected to remain price-resilient. Demand for new housing lots will stay strong, driven by population growth and migration, while delays in infrastructure and limited titled land will maintain the current supply squeeze. Developers and investors who can secure well-located land or established stock are likely to see continued value growth.

In short: Cairns remains one of Queensland’s most robust regional markets balancing lifestyle appeal with genuine growth fundamentals, even as supply pressures and affordability challenges reshape how and where people buy.

If you’re considering purchasing property in this competitive market, a Cairns Buyers Agent can help identify high-potential opportunities and negotiate the best price.