How Much Will an Investment Property in Cairns Really Cost Me?

When considering buying an investment property in Cairns, many potential investors focus on the upfront costs: the purchase price, stamp duty, loan setup fees, and ongoing expenses like insurance, property management, and maintenance. But the bigger question isn’t just “what will it cost me today?”, it’s “what will this property earn and be worth over the next five years?”

Upfront Costs vs Long-Term Returns

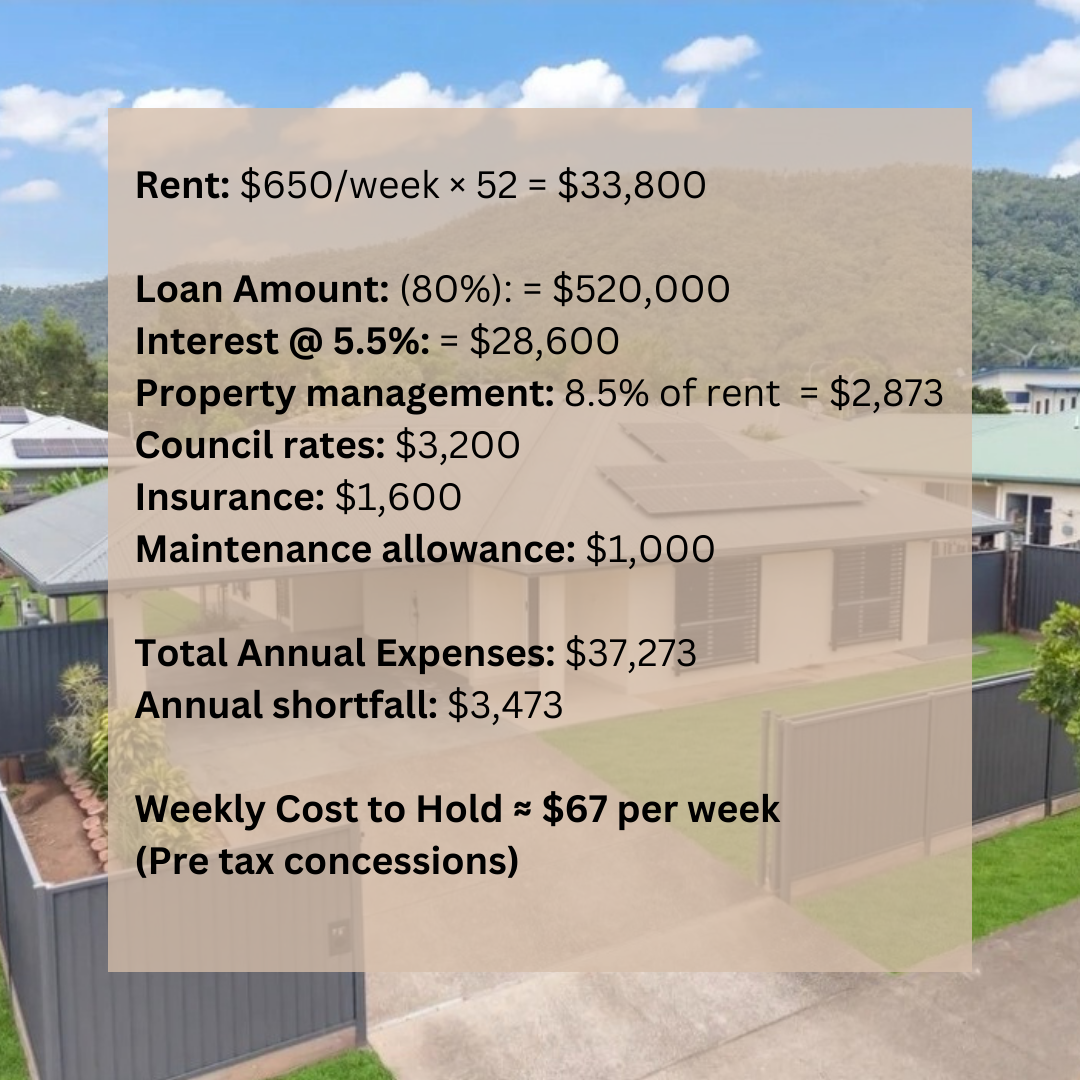

Let’s break it down with a practical example:

Purchase price: $650,000

Weekly rent: $650

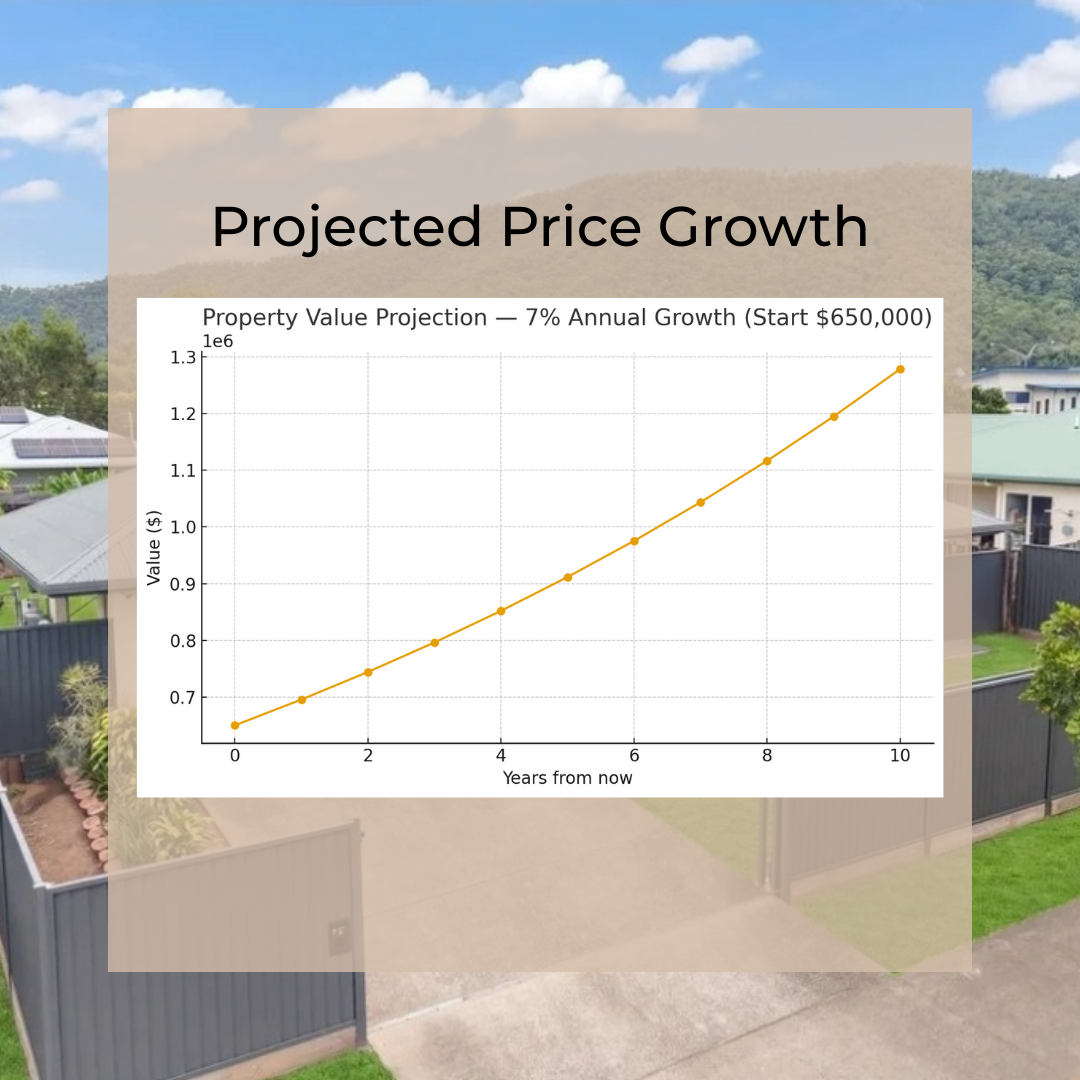

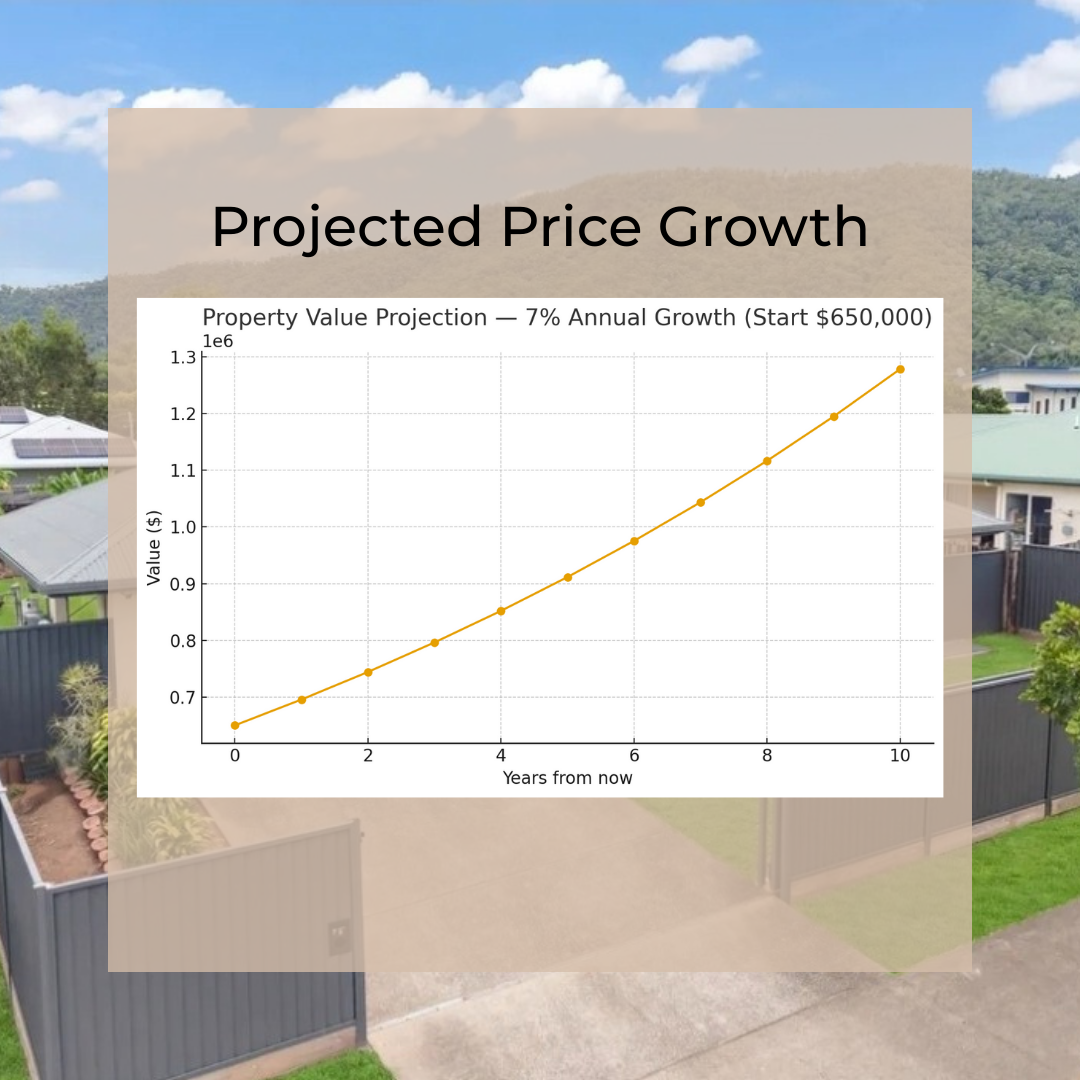

Property price growth: 7% per year

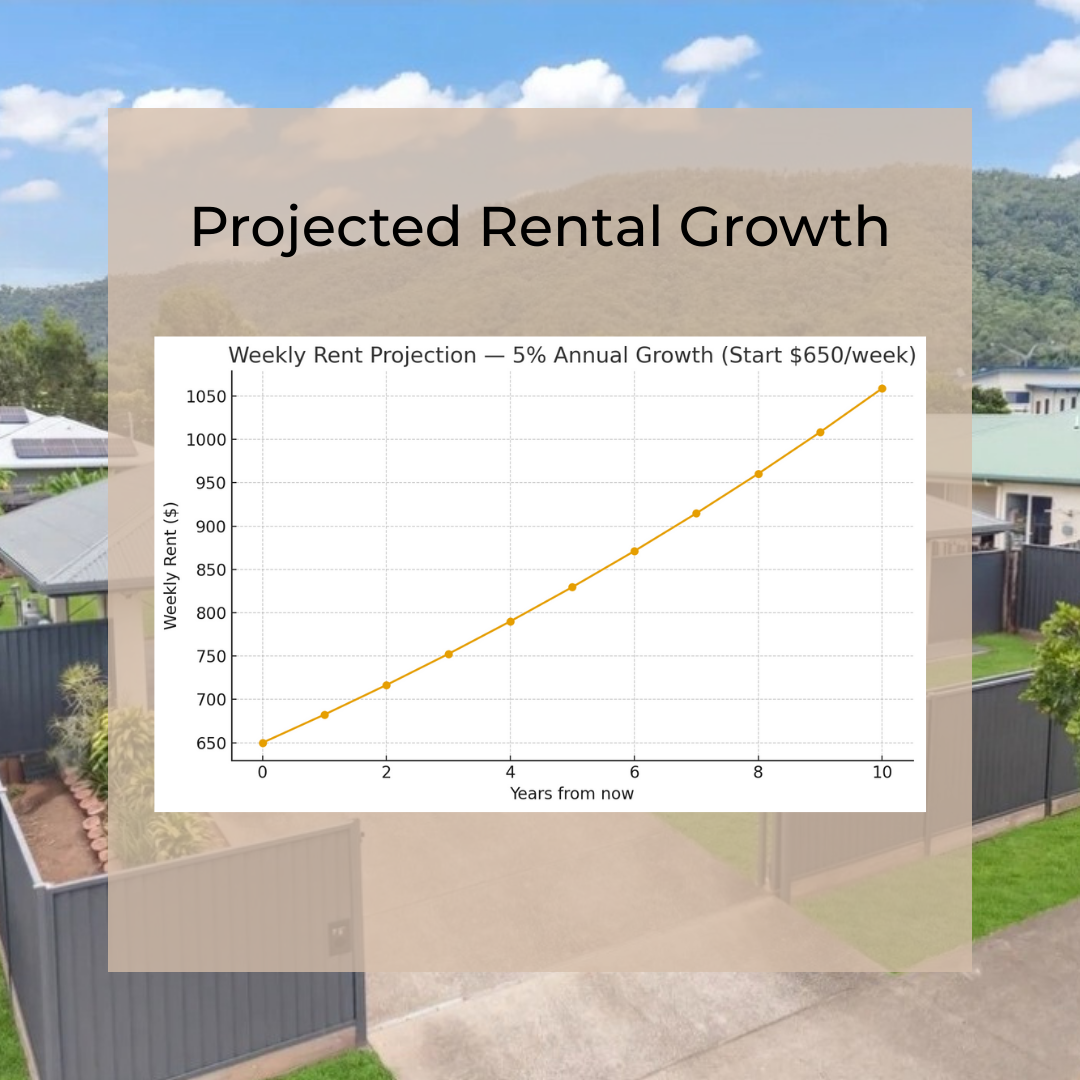

Rental growth: 5% per year

On paper, the upfront costs may feel high but cash flow and long-term capital growth tell a very different story.

Year 1: The Starting Point

In the first year, a property like this generates $33,800 in gross rent. While initial expenses like mortgage repayments, property management fees, and maintenance may make the first-year cash flow slightly negative), this is just the beginning.

Watching Your Investment Grow

Over time, both rental income and property value grow:

By year five, rental income has increased by more than 20% and the property value has grown by over $200,000. This is where long-term planning really pays off.

Why Year 5 Matters

Many investors get caught up in the short-term “cost” of buying property, but the real wealth is built over time. By year five:

Your property could be worth $911,000 a significant increase from the $650,000 purchase price.

Rental income has grown steadily, helping to cover ongoing costs and potentially generating positive cash flow.

The combination of rental yield and capital growth positions you to reinvest or expand your property portfolio.

The key takeaway: don’t judge an investment property solely on its first-year numbers. Focus on where it can be in five years, that’s when the true benefits emerge.

How a Cairns Buyers Agent Can Help

Navigating the Cairns property market can be tricky, especially when considering long-term performance. A Cairns buyers agent can help you:

Identify suburbs with the strongest growth potential and rental demand.

Calculate realistic long-term cash flow and capital growth projections.

Negotiate the best purchase price, saving you tens of thousands upfront.

Handle the due diligence and settlement process, reducing risk and stress.

Working with a local expert ensures that the property you buy today aligns with your financial goals five years down the track.

Final Thoughts

The “cost” of an investment property is more than the purchase price, it’s the combination of upfront expenses, ongoing costs, and the long-term growth potential. While some properties may be cash-flow negative in the first year, the bigger picture over five years often shows strong capital growth and rising rental income, creating real wealth for investors.

For Cairns investors, focusing on year-five performance rather than first-year cash flow is the key to making smart, long-term property decisions.